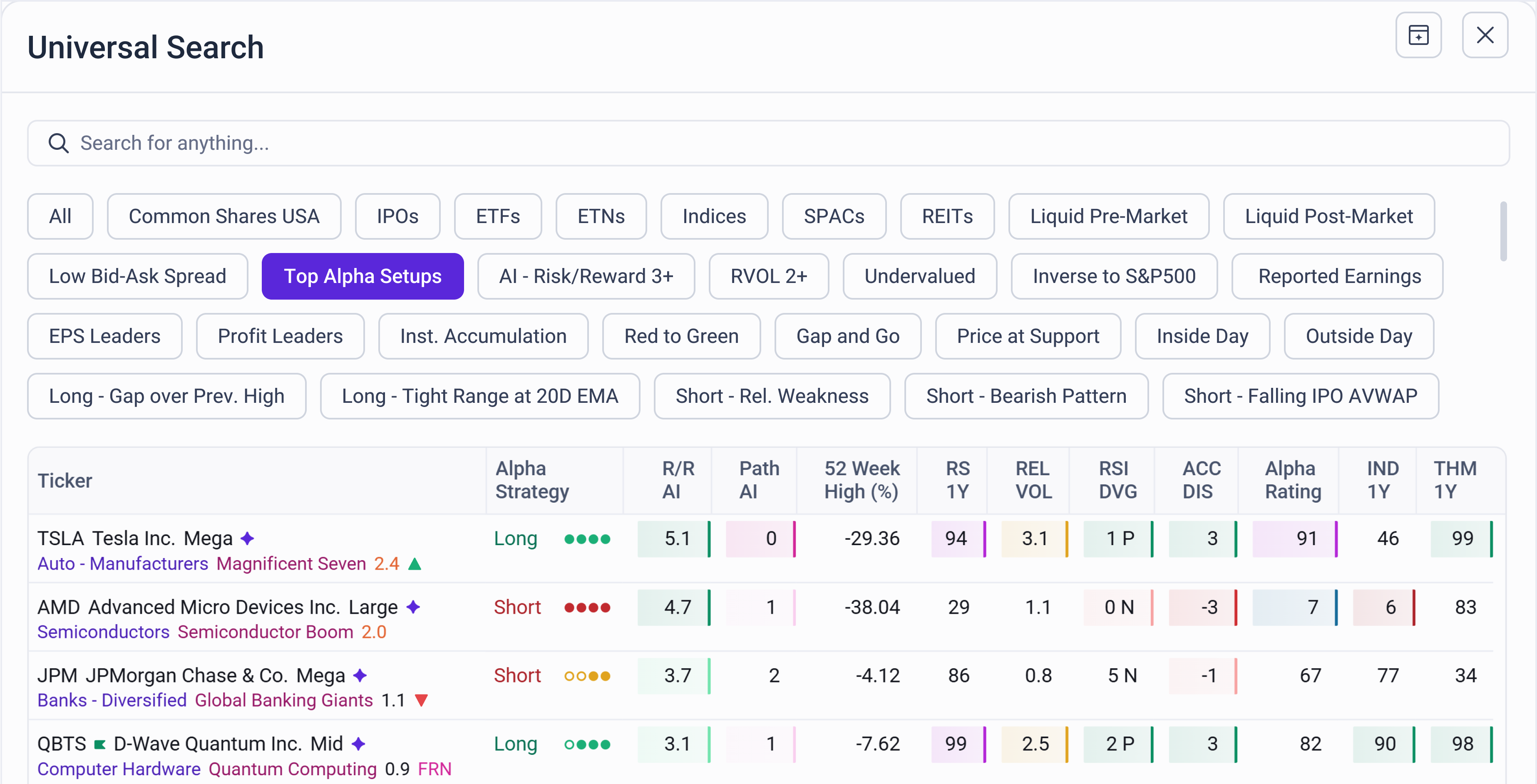

Top Alpha Setup

The Top Alpha Setup highlights the most compelling trade opportunities identified by MarketAlpha’s AI engine at any point in the trading day. It represents the highest-confidence combination of structure, momentum, risk/reward, and market alignment available in real time.

This signal adapts to the current session — whether pre-market, regular hours, or post-market — and is continuously recalculated based on new price action and data inputs.

Inclusion Criteria

To qualify as a Top Alpha Setup, a ticker must meet all of the following conditions:

- AI-Recommended Alpha Strategy — Directional bias (Long or Short) selected by the AI

- High Confidence Score — Strong model agreement between structure and price action (usually 3 or 4)

- Risk/Reward ≥ 2.0 — Clear reward opportunity with manageable risk

- Path to Target ≤ 2 — No more than two structural resistance/support zones between entry and target

- Liquidity Rating ≥ 70 — Must meet internal liquidity thresholds for reliable fills

- Volume ≥ 100K — Minimum daily volume to ensure tradability

- Acceptable Volatility — Must fall within a reasonable volatility range (avoiding extreme spikes or low-ATR compression setups)

These rules ensure only the strongest, cleanest setups are selected — removing noise and lower-quality signals.

Selection Process

The Top Alpha Setup is chosen from all AI-evaluated strategies using a weighted multi-factor model. This model considers:

- Chart Structure — AVWAP alignment, pivot strength, confirmed breakouts, trendline reactions

- Gap Analysis — Type, direction, size, and opening follow-through

- Price Action Patterns — Divergences, reversal candles, breakouts or rejections

- Volume Behavior — Confirmation of breakout, trend continuation, or exhaustion

- Fundamentals — EPS growth, sales strength, profit margins, liquidity, accumulation/distribution behavior

- Group Strength — Real-time industry and theme-level performance (daily and 1 year)

- Multi-Timeframe Consistency — Daily + intraday structure and confirmation agreement

- Other Proprietary AI Models — Internal scoring metrics used to evaluate total setup quality

Each of these factors contributes to a composite score that determines which ticker rises to the top.

Real-Time Updates

The Top Alpha Setup is monitored and recalculated live — meaning the selected ticker can change throughout the day as new setups emerge or existing ones lose strength.

- If a stronger opportunity appears, the signal updates

- If the current leader breaks down structurally, it is replaced

- If the market is low-conviction, no Top Alpha Setup may be shown

This ensures that the signal always reflects what is strongest right now, not what was strongest hours ago.

How to Use It

You can use the Top Alpha Setup to:

- Focus on the highest-confidence trade each day

- Scan the chart for structure and price action confirmation

- Compare group/fundamental strength alongside technicals

- Use it as a starting point for watchlists or daily trade planning

The Top Alpha Setup is designed to give you clarity, confidence, and focus. Instead of guessing what matters most, MarketAlpha isolates the one setup with the strongest alignment of technical, structural, and fundamental conviction — in real time.